Starting January 1, 2025, new regulations will take effect in Luxembourg, reshaping social contributions, the minimum social wage, and the remuneration of trainees and students. Based on index 944.43, these adjustments will directly impact employers and employees, particularly in areas such as health insurance, accident insurance, and pensions. Whether you are an employer or an employee, understanding these changes is crucial to prepare and adapt to the new framework.

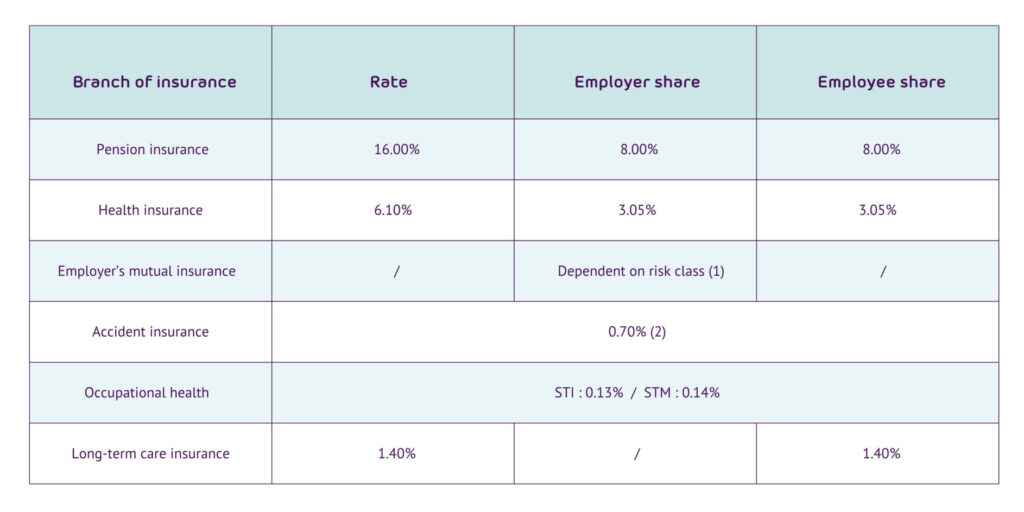

Social contributions

Situation on January 1, 2025 (index 944.43)

Contribution rate

(1) The classes of the Employers Mutuality are as follows:

(2) This single contribution rate, set at 0.70% for the year 2025, is thus multiplied for each contributor by its bonus-malus factor that can take the values 0.85; 1.0; 1.1; 1.3 or 1.5.

Minimum and maxima contributory (index 944.43)

(3) The annual maximum for the different branches of insurance corresponds to 12 times the monthly maximum. The maximum does not apply to the dependency contribution. The contributory basis for dependency contribution is reduced by an abatement of ¼ of the social minimum wage, i.e. 659.45 €.

Social minimum wage (index 944.43)

The level of the social minimum wage (application score 944.43 of the sliding scale of wages) has been since January 1, 2025 at:

Remuneration of pupils and students employed during school holidays

The remuneration of the pupil or student may not be less than 80% of the social minimum wage. In the index 944.43 the pupil/student is entitled to the minimum amounts shown in the table below, graduated on account of age.

Compensation for trainees employed by the company

Trainees whose duration of internships is at least 4 weeks, are entitled to the minimum amounts shown in the table below, graduated because of the duration of the internship.

*For trainees who have successfully completed a first cycle of higher or university education (BTS or Licence/Bachelor), the reference wage is the social minimum wage for qualified employees as provided for in Article L. 152-8. of the Labour Code.

For more information we kindly invite you to contact us: payroll@securex.lu or legal@securex.lu