The Luxembourg Government is preparing a major tax reform slated to enter into force on 1 January 2028. It represents one of the most significant changes to the personal income tax system in decades and will have concrete repercussions on the payslips and purchasing power of employees.

Here is the key information you need to know!

A single mandatory tax class: “Class U”

The three current tax classes (1: single taxpayers, 1a: single parents/retirees, 2: married couples or civil partners) will be merged into a single tax class known as Class U as of 2028.

The purpose of this reform is to introduce a truly individualised taxation system by removing any automatic tax advantage linked to marriage or registered partnership. It forms part of a broader effort to modernise and simplify Luxembourg’s tax system, adapting it to evolving family and professional models while making the tax scale more transparent, coherent, and reflective of today’s social realities.

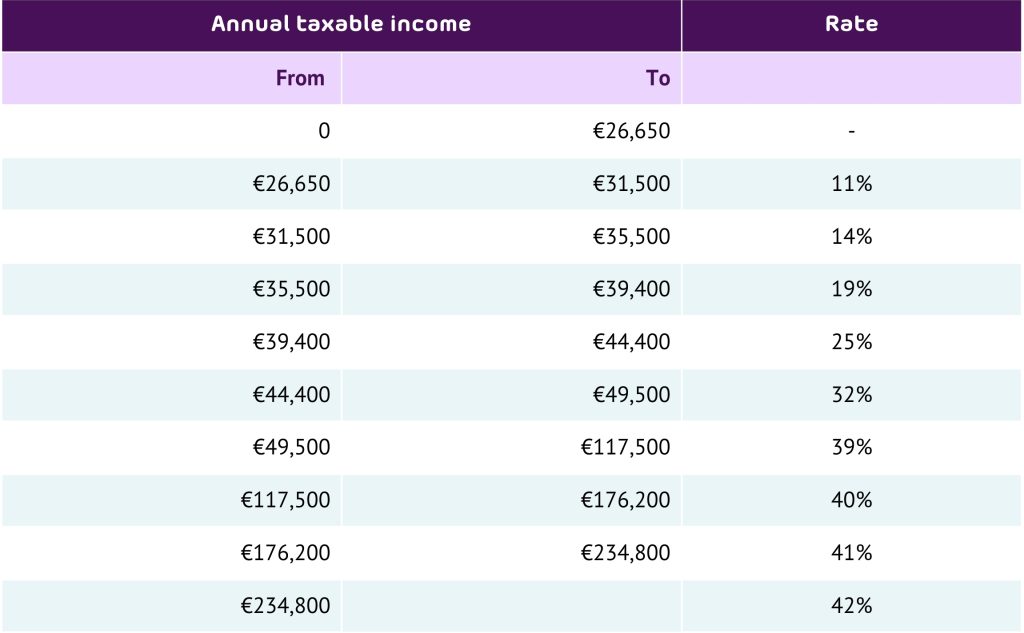

A new progressive tax scale

The bill proposes a single progressive tax scale applicable to all taxpayers, featuring a simplified structure with 10 brackets instead of the current 23, and a fully tax‑exempt first bracket up to €26,650.

As of 2028, the first €26,650 of income will no longer be taxed, compared with €13,230 today. This automatically reduces the amount of tax due for all taxpayers and is one of the most significant measures of the reform.

According to the Minister for Finance, the new tax scale will be more favourable for all taxpayers currently in Tax Classes 1 and 1a, and likewise for around 85% of those taxed under Class 2.

Important accompanying measures

Alongside the new tax scale and the single class, the reform introduces or strengthens several allowances and tax credits, particularly those supporting families with young children. An overview of the measures included in the bill currently under discussion is provided below.

“Early childhood” allowance

A new annual tax allowance of €5,400 is introduced for each child aged 0 to 3, to take better account of early childhood costs. If the child is raised by a single parent, that parent receives the full allowance. For couples, the allowance is shared equally, with each parent able to deduct 50% of the amount.

Single‑parent tax credit

The Crédit d’Impôt Monoparental (CIM) [single‑parent tax credit] will be increased from €3,504 to €4,008 per year, thereby strengthening support for single‑parent families.

Increases of various deductions

The reform also provides for higher ceilings on several deductible expenses, reducing taxable income and generating additional net savings for most eligible taxpayers.

The following are affected in particular:

- Mortgage interest and insurance premiums: the annual deductible ceiling will be increased from €672 to €900, multiplied by the number of household members.

- Home‑savings schemes: deductible contributions will be increased to €1,500 per year for taxpayers aged 18 to 40, and €900 for others (currently €1,344 and €672 respectively).

- Childcare and domestic services: the flat‑rate allowance for domestic help, dependency‑related assistance and childcare costs increases from €5,400 to €6,000.

Entry into force and transitional period

The new single tax class will apply automatically as of 1 January 2028 to all taxpayers currently in Classes 1 or 1a, as well as to couples marrying or entering into a civil partnership after that date.

Couples married or partnered before 1 January 2028 may continue to benefit from the former Class 2 tax scale during a transitional period of up to 25 years (i.e., until the end of 2052), unless they voluntarily opt for the new single scale.

Another change: for couples who retain Class 2 during the transitional period, in the event of death or divorce, the class will now be maintained for 5 years (instead of the current 3).

Conclusion

The 2028 tax reform will bring significant changes to the calculation of income tax, with direct effects on the payslips and therefore on the purchasing power of employees.

Although the bill must still complete the legislative process, its main features are now known, so employers and employees can anticipate the likely impacts.

We will continue to monitor developments closely and will inform you in due course of the practical arrangements, so that you can approach these changes with confidence and calm.