With the summer holidays approaching rapidly, some of you may already be considering hiring students or pupils to replace staff on leave.

The first steps of students and pupils into the workforce come with strict obligations for employers. Let’s break it down!

Hiring pupils and students during school holidays

Luxembourgish legislation provides that students can be employed during school holidays. To that end, a specific contract must be concluded: the student contract, which must meet terms and conditions set out by the Labour Code.

Students are considered to be young people aged 15 to 27 (up to their 27th birthday), enrolled in a Luxembourgish or foreign educational institution and attending full-time education. Furthermore, any individual whose enrolment in school ended less than 4 months ago is also considered a pupil or student.

The student contract must necessarily be concluded in writing no later than the time the student starts to work. Employers are also required to submit a copy of this contract to the Inspection du Travail et des Mines (ITM) [Inspectorate of Labour and Mines] within 7 days of the start of employment. This communication can be made electronically via the platform MyGuichet.lu.

A student may be employed under a student contract from the moment he or she is regularly enrolled in a foreign institution with holidays that differ from those in the Grand Duchy of Luxembourg. A certificate of enrolment may be used to prove that the student is on holiday.

- Term of a student contract

The term of employment of a pupil or student cannot exceed 2 months per calendar year, whether in one or several contracts. This term is also expressed in hours, i.e. 346 hours in total per year.

- Remuneration for a student contract

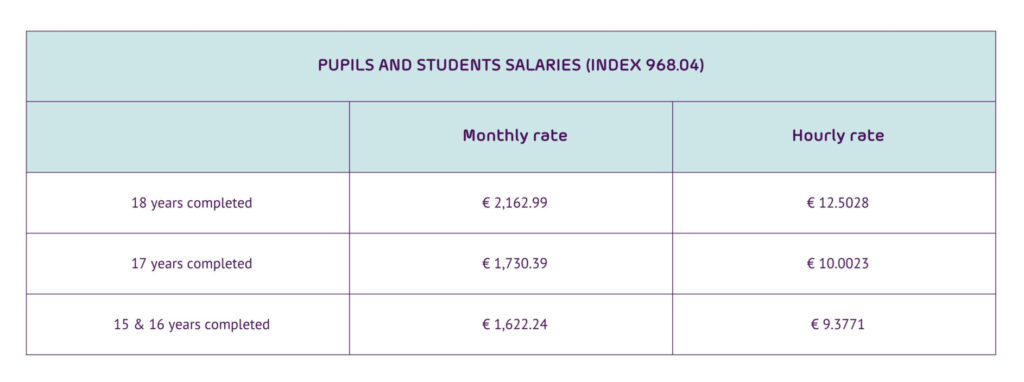

The remuneration of pupils and students must not be less than 80% of the minimum social wage and varies based on age.

- Social security and taxation under a student contract

Employing a student must be declared to the Centre Commun de la Sécurité Sociale (CCSS) [Joint Social Security Centre]. If a student does not have a national identification number (social security number, a 13-digit registration number), the employer must provide, without fail, a copy of the student’s ID along with the request for registration. For students or pupils from third countries, the request for a national identification number must be sent to the General Department of Immigration.

No social contributions are due except for the employer’s contribution to accident insurance.

Wages paid to students and pupils employed during school holidays are exempt from withholding tax, provided the hourly wage does not exceed €16 gross per hour. A request for exemption must however be submitted by the employer to the Administration des Contributions Directes (ACD) [Luxembourg Inland Revenue]. This request does not need to be made for each newly hired student who meets the conditions. Instead, a single request must be made for the first hire of the year, and the ACD will provide a document applicable to subsequent hires that year. This request must be renewed annually.

- Paid leave, illness, work on Sunday … What about these provisions for students?

Pupils or students employed during school holidays are not entitled to paid recreational leave. Special leave for personal reasons (such as bereavement or marriage leave) must be granted in cases provided by law, but no compensation is due to the student for these absences.

If a student falls ill, he or she is not entitled to remuneration during periods of absence due to illness.

Pupils and students of legal age who are employed during school holidays can work on Sundays and official public holidays, with standard pay increases as and where applicable.

Pupils and students aged 15 to 18 years may also work on Sundays or public holidays, subject to the following conditions:

- For work on Sunday: A full compensatory rest day must be granted within 12 days immediately following the Sunday worked + a 100% wage supplement;

- For work on a public holiday: A full compensatory rest day must be granted within 12 days immediately following the public holiday worked + same wage as Sunday work + statutory allowances applicable for working on a public holiday.

Pupils and students aged 15 to 18 years must be exempt from working every other Sunday, except for hospitality and restaurant sectors in July and August, where this restriction does not apply.

Hiring students or pupils outside school holidays

If a student is not on official school holidays, as certified by an enrolment document, he or she may still be hired under a fixed-term contract.

- Term of fixed-term contracts outside school holidays

The weekly working hours for such a fixed-term contract cannot exceed an average of 15 hours over a period of one month or 4 weeks.

Successive fixed-term contracts may be signed with the same employer for a total maximum duration of 60 months (5 years), including renewals. These contracts can be renewed more than twice, even exceeding 24 months, without being automatically considered as permanent contracts.

- Remuneration of pupils and students under fixed-term contracts

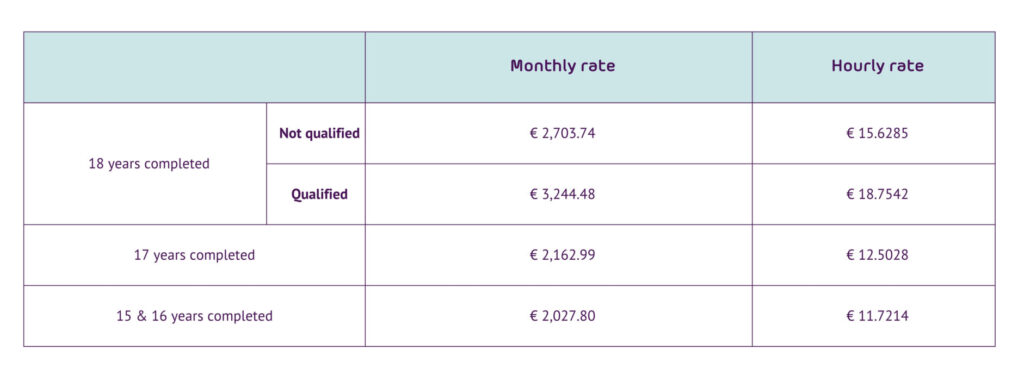

Employers must pay at least the minimum social wage (currently €2,703.74 at index 968.04).

- Social security and taxation for students under fixed-term contracts outside school holidays

Even though students or pupils are hired under fixed-term contracts, they must be treated as regular employees.

Consequently, students employed under a fixed-term contract outside school holidays must be registered with all Luxembourgish social security schemes. For students without a national identification number (social security number, a 13-digit registration number), the employer must, as in the case of the student contract, provide a copy of the student’s ID along with the registration request. For students from third countries, the request for a national identification number must be sent to the General Department of Immigration.

The standard withholding tax system applies to students, and they will receive a tax card.

- Paid leave, illness, work on Sonday… what about these provisions for students under fixed-term contracts?

As fixed-term contracts outside school holidays are limited to 15 hours per week, students are entitled to a proportional amount of statutory leave. The same principle applies to public holidays.

There is no legal restriction preventing students of legal age from working on Sundays. If they do, standard wage increases apply.

However, students aged 16 to under 18 years cannot work on Sundays, unless in cases of force majeure or if the existence or safety of the business so requires.

In case of illness, pupils and students are subject to the same requirements as ordinary employees. They must duly notify the employer and submit a medical certificate. Their sick leave days are paid just like a regular employee.

Conclusion

Hiring students, whether during school holidays or outside these periods, benefits both the students and employers. Effective management requires a clear understanding of the regulations governing this practice!