Here you will find all the latest news about HR management in Luxembourg!

- New layout for the CCSS Invoice

- Contribution to the Chamber of Employees

- Procedures for hiring pupils and students

- Final call for INFPC [National Institute for the Development of Continuing Vocational Training] applications

- 34 days finally ratified for French residents!

- Tax return forms now available: Ready with your income? Set? File!

- Publication of the list of occupations in severe shortage

- The index triggered on May 1st

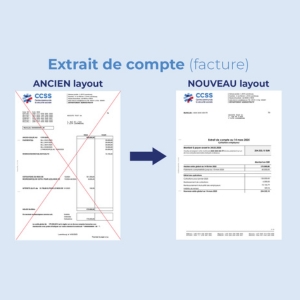

1- New layout for the CCSS invoice

In early March 2025, the Centre Commun de la Sécurité Sociale (CCSS) [Social Security Common Centre] unveiled the new design of the CCSS invoice sent to employers.

This more modern layout should enhance readability of key details. A guide posted by the CCSS on its website is intended to assist with comprehension.

By way of reminder, this invoice (also known as an “account statement”) is sent monthly by the CCSS to employers so that they can remit employee and employer social security contributions for Month M, calculated on the basis of salary declarations submitted in Month M+1. It includes contributions for Month M, contributions due under the moving ceiling system, reimbursement for mutual insurance from Month M based on sickness declarations, and any adjustments for prior months.

2- Contribution to the Chamber of Employees

As every year, employers are required to pay the contribution to the Chamber of Employees, which Employers will be required to submit by the account statement sent by the CCSS in July.

This contribution is set at €35 per employee and is deducted from the net salaries of employees during the March payroll.

It is worth noting that this contribution is payable only once per employee. In cases where an individual has multiple employers, the contribution is paid by the employer with the longest working hours. If the hours worked are equal, the longest-standing affiliation shall determine the responsible employer. In May, the CCSS will send a statement to all employers listing employees for whom they must pay the contribution to the Chamber of Employees, along with the total amount. Any corrections regarding employee affiliations can be made before the July invoice is issued.

3- Procedures for hiring pupils and students

With the summer holidays approaching, some of you must undoubtedly be considering hiring students or pupils to cover for staff on holiday. Certain formalities must be met to that end.

The contract by and between an employer and a student must be concluded in writing without fail at the latest when the student starts working.

If no written contract exists, the employment shall be deemed to be permanent, and proof to the contrary is not admissible. It is therefore not possible to hire a student under a verbal agreement.

The student contract must be drawn up in three original counterparts:

- One for the student

- One for the employer

- One for the Inspection du Travail et des Mines (ITM) [Inspectorate of Labour and Mines]: the contract and a copy of the student’s identity card must be sent to ITM within 7 days as of the commencement of the contract via postal mail or MyGuichet.lu.

The period of employment may not exceed 2 months or 346 hours per calendar year, irrespective of whether one or several contracts with one or several employers are involved. It is therefore possible to conclude one or more student contracts for part-time employment over a period of more than two months for one or more summer school holidays, provided the combined hours do not exceed 346 (twice 173) hours in a calendar year.

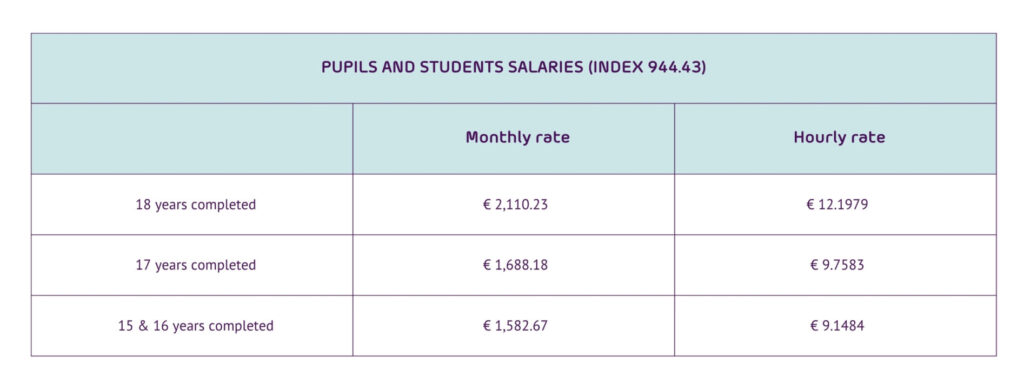

The wage paid to a student or pupil cannot be lower than 80% of the minimum social wage. With the index at 944.43, the student or pupil is entitled to the amounts indicated in the table below, graded according to age.dice 944,43, l’élève/étudiant a droit aux montants minima repris dans le tableau ci-après, gradués en raison de l’âge.

The employer is required to file a declaration of entry with the Social Security Common Centre. Conversely, only the employer’s contribution for occupational accident insurance will be due.

The student’s remuneration is consequently not subject to health insurance, pension insurance, or long-term care insurance. For the employer, the total cost of a student’s wage will therefore be limited to the gross wage plus the accident insurance contribution.

Furthermore, the student is exempt from income tax provided his or her hourly wage does not exceed €16. The gross wage paid to the student shall therefore be identical to his or her net wage.

To this end, the employer must submit a request to the Luxembourg Inland Revenue (Administration des contributions directes – ACD). This request must be made once per year for all students, i.e. it is not submitted individually per student. It is therefore advisable for the employer to make this request when hiring the first student of the calendar year.

4- Final call for INFPC [National Institute for the Development of Continuing Vocational Training] applications

As you know, employers can each year receive financial support for training costs incurred the previous year. To that end, your INFPC application must be submitted before 31 May!

Employers can qualify for financial aid of 15% of the amount invested in 2024 in the training of their employees.

The main costs eligible for reimbursement include:

- Salaries of the participants and internal company trainers;

- Fees for external training providers;

- Travel, accommodation, and meal expenses relating to training.

Investment in training is capped depending on the size of the company:

- 20% of the wage bill for companies with 1 to 9 employees;

- 3% of the wage bill for companies with 10 to 249 employees;

- 2% of the wage bill for companies with more than 249 employees.

A company with 5 employees may thus receive a 15% reimbursement on 20% of its wage bill invested in training, whereas a company with 100 employees may receive 15% on 3% of its wage bill invested in training.

The aid is increased by 20% for employees who are trained although they hold no diploma, with less than 10 years of seniority; or if they are over 45 years old.

To obtain reimbursement, a specific application must be completed and documented, including invoices, signed attendance sheets, and data on employees and payroll. This co-financing application to the National Institute for the Development of Continuing Vocational Training must be submitted no later than 31 May 2025.

5- 34 days finally ratified for French residents!

In February 2025, France officially ratified the amendment to the convention between France and Luxembourg, increasing the tax tolerance threshold to 34 days for employees residing in France but working in Luxembourg.

This means an employee can perform his or her salaried work (including telework, business trips, or training in another country) for up to 34 days outside Luxembourg, while remaining taxable in Luxembourg.

Although the French ratification came late, the amendment has retroactive effect. The 34-day tax threshold has thus been applicable since 1 January 2023 for cross-border workers residing in France.

By way of reminder, this threshold represents a tax tolerance by virtue whereof a cross-border employee can work outside Luxembourg for up to 34 days while remaining taxable there.

Germany, Belgium, and France have now harmonised their positions by setting this threshold at 34 days.

6- Tax return forms now available: Ready with your income? Set? File!

The tax return forms for 2024 income have been available since 7 April 2025. The personal income tax return for the 2024 tax year must be filed duly, completed and signed, no later than 31 December 2025.

There are now three ways to file, namely via:

- The online assistant on MyGuichet.lu (requires LuxTrust access);

- Paper form, available on the Luxembourg Inland Revenue (Administration des contributions directes – ACD) website, to be sent by post to the relevant tax office;

- PDF form available on the ACD website to be completed and filed electronically to the relevant tax office.

7- Publication of the list of occupations in severe shortage

The 2025 list, for reference year 2024, of occupations in severe shortage was published on 31 March.

Compiled by the Agence pour le Développement de l’EMploi (ADEM) [Employment Development Agency], this identifies occupations in high demand, for which very few candidates are available through ADEM. It is based on criteria such as the number of vacancies declared to ADEM, the number of jobseekers registered for the same occupation, and the number of declared vacancies for which no suitable candidate matching the required profile could be found.

By way of reminder, employers wishing to hire staff must declare the vacant position to ADEM.

This declaration must be made within three business days following the publication of the job offer, whether in the press or on the company’s website. After this step, ADEM will send an acknowledgement of receipt, and the job advertisement will remain active on ADEM’s website for two months. After that period, it will be automatically removed unless the employer explicitly requests an extension.

This list of occupations in severe shortage is especially important when hiring third-country nationals. If the declared vacancy corresponds to an occupation on the severe shortage list, the certificate required to recruit the selected candidate will be issued by ADEM within five business days of the acknowledgement of receipt—facilitating and speeding up the recruitment process.

8- The index triggered on May 1st

Salary indexation in Luxembourg has just been officially announced by STATEC on April 29, 2025. It will be effective from May 1st. The last indexation took place on September 1st, 2023.

Automatic indexation occurs when the six-month average of the index records a difference of 2.5% compared to the last threshold.

By way of reminder, indexation is a public policy measure and applies to all employees under an employment contract in Luxembourg, as well as to students, interns, and apprentices, whose remuneration will be increased by 2.5% accordingly.

Would you like to receive the latest news concerning HR in Luxembourg directly in your inbox? Sign up for My HR Update: https://www.securex.lu/#hr-update