Social security in Luxembourg: a guide for cross-border workers

Social security for cross-border workers in Luxembourg can seem complex with its legal and administrative specificities. This training helps you understand the affiliation rules, the benefits your employees are entitled to, and the procedures to follow to stay compliant. Whether you’re an employer or a cross-border worker, master the key points to navigate this system smoothly.

Payroll and Personnel Administration

Payroll and personnel administration is a key pillar of HR management. This training provides you with the necessary skills to master payroll, social contributions, legal obligations, and much more. Whether you are a beginner or experienced, learn how to effectively manage each step, from hiring to contract termination, while complying with all current regulations.

New regulations regarding trial periods for fixed term contracts

Until now, the Labor Code applied the same regulations on trial periods to CDD as to permanent employment contract (Contrat à durée indéterminée – CDI), so that it was sometimes legally possible to cover the entire duration of the CDD with a trial period, which made no sense.

Students and interns : all you need to know

Welcoming students and interns into your company is a rewarding opportunity, but it also involves specific legal obligations. To ensure optimum management of their status, it’s crucial to be familiar with the appropriate contracts, remuneration rules and administrative formalities.

Understanding your payslip?

This course guides you through each element of the payslip, from structure to calculations and deductions at source. The knowledge you acquire will enable you to explain the payslip simply to your employees and answer their questions.

Staff Delegation : setting up and responsibilities

Everything you need to know about staff delegation members: role, resources, missions, status, rights, obligations… The ideal training course to help you set up your new delegation with peace of mind.

Social elections: how to prepare?

Discover the essential steps for organizing stress-free social elections, master the rules and maximize participation. Turn this legal obligation into a real opportunity to strengthen relations within your company.

Tax reform 2025

On 17 July last, Minister for Finance Gilles Roth announced a comprehensive tax reform to enhance the purchasing power of employees and the competitiveness of Luxembourg. A bill has already been submitted to Parliament (No. 8414). We hereby present the aspects of the reform related directly to salary management, with the first part dedicated to measures for reducing the tax burden on households and the second part focusing on proposed changes to strengthen the country’s attractiveness.

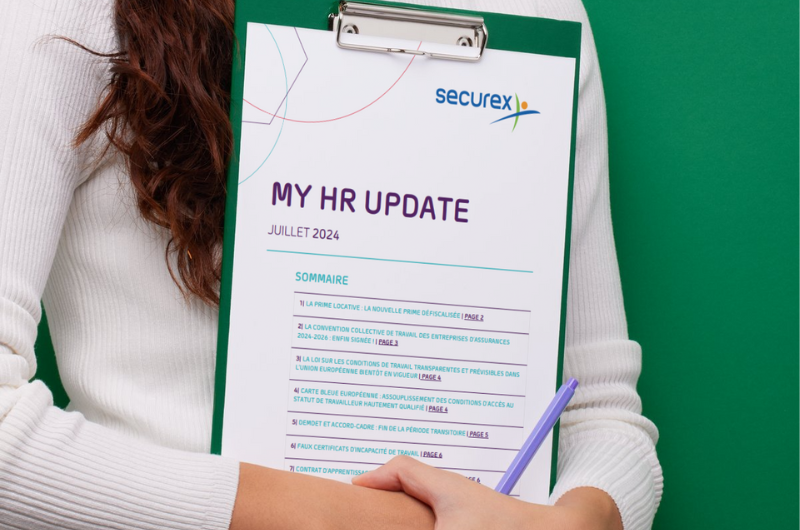

MY HR UPDATE – July 2024

Rental subsidy, collective agreement for insurance companies, law on transparent and predictable working conditions… find out all the latest HR news in Luxembourg in our latest HR Update of July 2024!

DEMDET and framework agreement: end of the transitional period

Since July 1, 2023, the teleworking framework agreement allows cross-border employees to work up to 49% of their time from home while maintaining Luxembourg social security coverage. With the end of the transitional period, new retroactivity rules now apply.